If we take a look at our on-market observation process, we are declining about 80% of all offered Content Sites on platforms like flippa.com or empireflippers.com without even further checking them in detail or initiating our pre-DD process. The reason for that is based on pure, automated vertical match or mismatch evaluation.

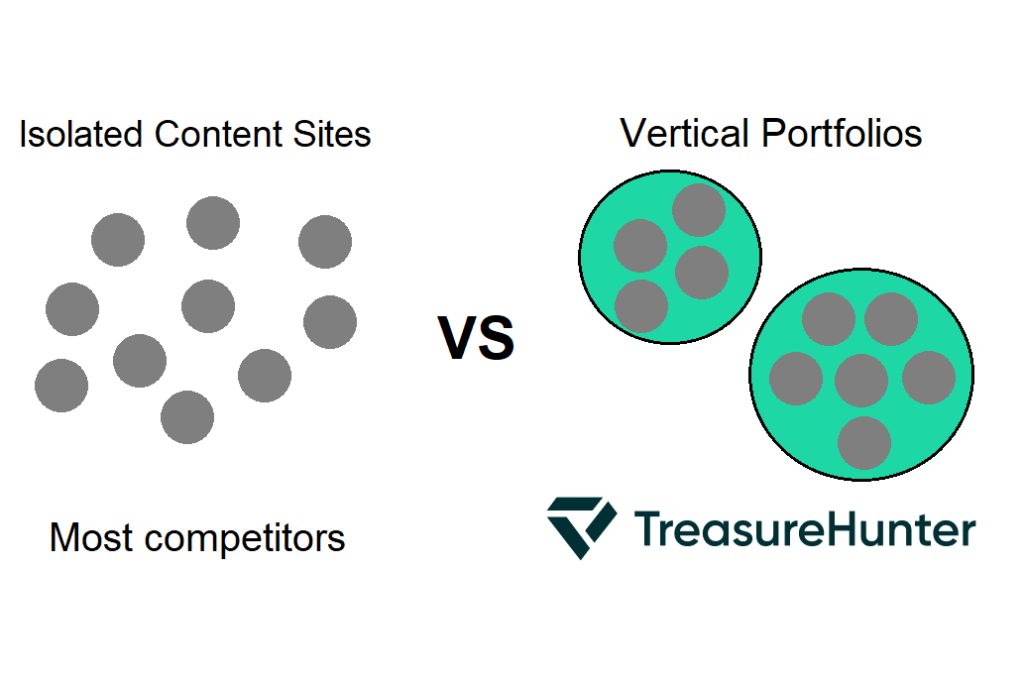

At TreasureHunter, we aim to build strong portfolios of grown Content Sites in specific, passion-driven verticals to take advantage of operational synergies, transform individual assets into market-dominating businesses and therefore benefit from multiple arbitrage.

While some of our competitors are into buy & flip business models like domainmagnate or are buying – in parts – isolated Content Sites like a website around dogs and art as onfolio does, our focus is set on aggregating established assets to gain competitive advantages. In this article, we explain and showcase them to you in detail – let’s go!

Synergies and advantages when operating a website portfolio in specific verticals

Basically, all synergies are i) reducing operational costs and/or ii) increasing revenues. There are some synergies that apply even if you are aggregating assets that are not in one vertical, like

- Reduced costs for technical infrastructure and tools like SEO or content management software; no matter in what niches, markets or verticals you are, a tool like ahrefs or sistrix will be relevant for all content sites no matter what vertical they belong to as the online marketing and editorial mechanics are quite similar.

- Reduced costs for overall management and communicational efforts as some process might be aligned for assets from different verticals. For example, the process of how to editorially curate content inside a CMS like WordPress will be very similar if you are running a site around pets and a site around e-sports

But that’s pretty much it. No game changer, right?

Things become way more interesting if we take a look at synergies that come along once you are focusing on assets in specific verticals, that are topically matching. Those synergies at TH help us to reduce operational costs by >30% and in the same time increase revenue by >20% compared to an isolated asset curation.

These vertical-based synergies are:

- Supply Chain Efficiency – This term usually applies for industrial business. In our case when operating content site we are thinking about content production, whereas one editorial good equals one article. This supply chain evidently runs smoother if those content sites are part of one portfolio, as there is a wide pool of authors and editors that are able to work on it, compensate staff bottlenecks and are willing to work for less money per good, as they therefore receive more consistency of work. The logic behind that is simple: If you are an author and are writing for one isolated content site in total 3 articles per month, you will charge higher rates than if you write for a company that is operating 10 content sites in that vertical and you therefore get 10 or 20 articles to write on a consistent level.

- Reduced Sales- and Marketing Costs – You will negotiated with the same sales agents and advertisers deals for all assets in your portfolio, not just for one content site. Depending on the size of your portfolio, this synergy has the potential to lower sales and marketing costs by >90% (!)

- Lower Headcount-Size – Lower headcount-size means less management and communication effort, but also less accounting and bookkeeping work. Operating assets that belong together on a topical level require fewer authors and editors (with more time commitment) and fewer sales managers based on the reasons elaborated above.

- SEO synergies – Topical relevancy is one of the key qualities of backlinks for many years now. Of course, you want to interlink the assets you own to navigate both, users and linkjuice, through the sites and articles you have. This is only doable if those content sites belong to the same vertical, targeting similar topics. Besides that, thinking about SERP-domination, you can use the data you generate for one asset to optimize keyword strategies and other SEO measures for all other assets inside the same vertical easily to ensure that each asset ranks better for relevant search terms as if it would as an isolated website.

- Social Media / Inbound synergies – Exchanging followers from one asset to another and therefore leveling-up the amount of touchpoints with the readers accelerates the growth of newsletter and social media followership but also optimizes the community building, which means more stable, diversified traffic streams for all of your assets.

- Sales and Monetization synergies – Besides the previously discussed cost savings, you obviously also take advantage of upselling and therefore dramatically decrease your costs per acquired customer aka advertiser. Again, this synergies will only apply if you have more than one asset in the same vertical serving the same clients and advertisers.

Building real, stable businesses out of isolated assets pays off – multiple arbitrage and additional benefits

As we have seen above, aggregating assets in specific verticals leads to lower costs, more revenue and therefore increased profitability when growing these assets.

When we think about the value of these assets grouped together in vertical portfolios, another aspect comes into play which is kind of the magic evaluation booster for us: multiple arbitrage.

Besides those obvious synergies and the multiple arbitrage, there are plenty of soft factors that we are able to benefit from. Such as heaving more opportunities to attract industry experts (who want to work with the largest media group in their vertical) as writers or content attributors, entering partnerships with smaller assets in the vertical (like via our content licensing model), or getting more industry-relevant PR and offpage-SEO traction.

If you have any questions around our approach on building content site portfolios in verticals feel free to reach out at any time:

[email protected]

https://www.linkedin.com/company/treasurehunter/

https://twitter.com/treasurehmedia

https://www.facebook.com/treasurehuntermedia

About the author

Benjamin is Co-Founder & Co-CEO at TreasureHunter and Co-CEO at ever-growing, a leading European pubTech company in the product comparison market. Part of his job is to regularly test and implement new growth strategies in the areas of content marketing and SEO, with which his teams generate high 7-digit traffic streams per month.

Benjamin is Co-Founder & Co-CEO at TreasureHunter and Co-CEO at ever-growing, a leading European pubTech company in the product comparison market. Part of his job is to regularly test and implement new growth strategies in the areas of content marketing and SEO, with which his teams generate high 7-digit traffic streams per month.